Chapter 13 plans can be extended up to 7 years 7 year Chapter 13. An existing chapter 13 plan can be extended to 7 years if the case had been confirmed and then the covid-19 virus caused payment issues. On March 27, 2020, the President signed into law the historic Coronavirus Aid, Relief, and Economic…

Loan modifications under CARES Act. The law firm assists with loan modifications and mortgage relief for those impacted by the coronavirus pandemic. This blog post discusses loan modifications and mortgage relief for those impacted by the coronavirus pandemic. Federal and state governments, and financial institutions and loan servicers, have announced plans to help struggling homeowners…

Small Business Reorganization Act. This is a chapter 5 bankruptcy designed to make the process easier for a business than a Chapter 11 reorganization Small businesses now have an alternative to a chapter 11 bankruptcy called the chapter 5 bankruptcy. This statute, Chapter 5 is designed to ease some of the burdens that certain mechanical processes in…

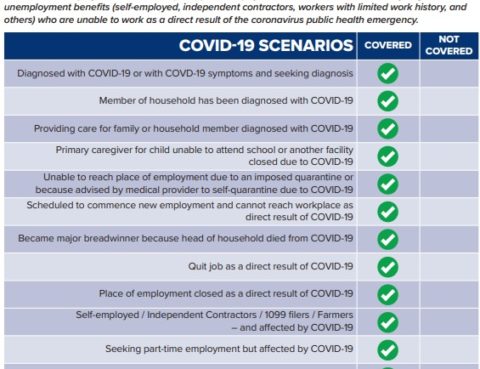

PUA – Pandemic Unemployment Assistance. This is subject to change at any time. This information was posted here in April 2020. Unemployment now provides payment to folks not traditionally eligible for unemployment like self employment, independent contractors This is subject to change. It was posted here April 2020. New York State remains on PAUSE through…

This book discusses how to raise your credit score. It includes new ways that you can increase your credit that previously were not available. For example, rent that you pay and the cell phone bill you pay can count towards increasing your credit score. This is a MUST read because you can increase your score…

Small business owners qualify for chapter 7 bankruptcy. The Coronavirus aftermath is destroying small businesses. The small business debt is typically debt which has been co-signed by the business owner. That makes the owner liable. The creditors will look to collect from the business owners which means dealing with creditors, lawsuits, wage garnishment, judgments, liens,…

Glossary of Credit Terms 2-percent rule A rule of thumb to see if refinancing a mortgage loan is a good financial decision. The rule says you should refinance if you can lower the interest rate on the loan by at least 2 percentage points (for example, to 7% percent from 9%). However, factors such as…

STEPS IN A BANKRUPCY CASE Mandatory Credit Counseling You must obtain a certificate from an approved credit counseling agency before you can file your case. It is expected that this can be done over the internet and will likely cost approximately $35- 45. A copy of any payment plan devised by the counseling service must…

Convert a Chapter 13 to a Chapter 7 A chapter 13 client (currently in a payment plan with a confirmed case) has had a significant revenue loss due to the virus. They told me they wanted to apply for a SBA loan under the CARES act. However, in reading through the application guidelines, these loans…